World Oil Industry Outlook

The outlook’s objective is to analyze trends that will determine the future of global oil and gas markets.

KEY CONCLUSIONS OF THIS OUTLOOK

1. Global demand for liquid hydrocarbons will continue to grow. Growth of population and consumer class in Asia will support oil demand increase. The main increase in consumption will come from transportation sectors in developing countries.

2. Increase of oil production in North America won’t lead to a global oil prices collapse. Modern methods for evaluation of shale oil reserves allow considerable uncertainty therefore we are cautious in our estimates of the US production potential. A number of factors that include the growing cost of reserve replacement, the balancing role of OPEC and depreciation of US dollar will help to support the current levels of oil prices in long term.

3. The European oil refining industry is experiencing a systemic crisis. Such ongoing trends as the decrease in US gasoline imports and commissioning of new highly effective oil refineries in the Middle East and Asia will continue to have a long- term negative effect on European producers.

4. Gas consumption will grow faster than oil consumption. The greatest potential for gas consumption growth is in China, while the European markets - Russia’s traditional clients - will continue remain stagnant.

5. Maintaining oil production in Russia requires large-scale use of new technologies. The currently planned projects are unable to compensate production decline on brownfields. Without large-scale use of new technologies, oil production in Russia will begin to fall in 2016-2017.

6. The Russian oil refining industry will undergo significant modernization but risks of gasoline deficits remain. Measures taken by the Russian government will promote modernization of domestic oil refineries but the situation on the automotive gasoline market will remain quite tense until 2016-2017.

7. Main challenge for Russian gas industry is the access to the new markets. Competition on the global gas markets will continue to rise. To develop gas production in Russia, Russian companies have to gain access to growing markets.

GROWTH FACTORS AND CHALLENGES FOR OIL MARKET

Growth factors:

Population growth, urbanization

Motorization in Asia

Growing costs of exploration and production

OPEC policy

Dollar depreciation

Principal Challenges:

Increase of unconventional oil production in North America

Increase of oil production in Iraq

Deepwater shelf production

Biofuels production growth

Gas to liquids (GTL) expansion

Oil price impacts:

Supply and demand

Macroeconomic situation

Financial markets

Geopolitics

US Dollar exchange rate

WORLD POPULATION

Our planet’s population will continue to grow rapidly. Between 2010 and 2025 global population will grow by more than 1.1 bln people. Greatest population growth will be registered in the developing countries, while in the developed countries population will remain relatively stable. High rates of population growth are expected, first of all, in India, which will become the world’s most populous country by 2020. Explosive population growth is also forecasted for the African countries where it will be the result of improvement in socio- economic conditions and quality of medical services. Along with population growth, developing countries will experience the movement of rural population to the cities, known as urbanization. According to the estimates of Mckinsey Global Institute, by 2025 440 cities in the developing countries will contribute up to half of the global GDP growth. At the same time the levels of consumption will grow. It is expected that by 2025 the size of the urban consumer class will grow by 1 bln people and overall middle class will amount to more than 50% of the total global population. The main growth will come from the developing Asian countries. Urbanization and growth of the consumer class in developing countries will, in turn, promote growth in demand for real estate, infrastructure, cars, hi-tech goods and, as a result, energy resources.

OIL DEMAND

Demand for liquid hydrocarbons will continue to grow. Global demand for liquid hydrocarbons will continue to grow annually by 1.2% on average and will, in our estimates, reach 105 mb/d by 2025. The greatest surge in oil demand will come from the transportation sector, for which oil is the principal energy source (over 90%). Consumption of liquid hydrocarbons will increase in the developing countries where the transportation industry is undergoing rapid growth. Analysts expect to see significant growth in the number of cars as well as the development of sea, air and railway transportation. In addition to this, growth in demand for oil in the developing countries will be further encouraged by the industrial sector, in particular, the petrochemical industry. At the same time, consumption of liquid hydrocarbons in the developed countries will remain r elatively s table due to the low rates of economic growth and further improvements of fuel economy. Despite stable growth rates oil’s share in the global consumption of energy resources will gradually decrease, because of substitution for other energy sources in such sectors as power generation and housing.

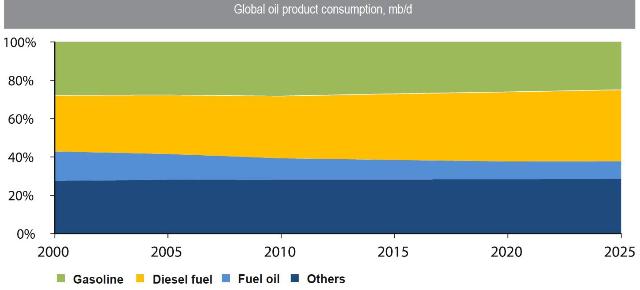

GLOBAL OIL PRODUCT CONSUMPTION

MOTORIZATION IN ASIAN COUNTRIES

The motorization of the population in the developing countries is one of the principal factors of the future growth in demand for oil. Today the developing countries are severely lagging behind the developed ones in terms of the number of cars per 1,000 people, thus creating conditions for significant growth in the size of the global car fleet. In the forecast period, the most noticeable increase in car ownership will take place in China, whose car market has already entered intensive growth stage. In today’s China the number of cars per 1,000 people is 40. By 2025 this figure will be close to 200, leading to 220 mln car fleet increase for the period of 2010-2025.

Significant growth in car ownership will also be registered in India and other developing Asian countries. By 2025 large-scale growth of car ownership will begin in Africa.

Freight cars and trucks will make a strong contribution to the growth in consumption of motor fuels. Total number of such cars is expected to grow by 140 mln by 2025.

According to our estimates, the aggregate global car fleet will grow by 670 mln over the period of 2010-2025. Leading to increase in fuel consumption by 9 mb/d.

FUEL ECONOMY IMPROVEMENT

We are currently observing a sustained trend towards decrease of fuel consumption in passenger cars. This is happening for a number of reasons: the designs of car bodies and engines are improving, the quality of engine fuel is getting better and hybrid technologies are being implemented more often.

Growth in the size of car fleet will be accompanied by changes in its structure. However, over the course of the whole forecast period internal combustion engines will preserve their dominant position. Their share in the total car fleet will amount to more than 80%. At the same time the share of cars with diesel engines will slightly increase.

The decreased rate in fuel consumption over the last 20 years was due to the improvement in its quality. Engines that consume RON-95 gasoline became an industry standard. The further decrease in fuel consumption rate will be evolutionary, not revolutionary. Promising t rends i n c ar i mprovement, such as the hybrid engines, reduced rolling resistance tires, decrease in weight and improvement in aerodynamics, will help to reduce consumption of fuel in passenger cars by 30% by 2025.

UPSTREAM COSTS INCREASE

The last decade was characterized by the unprecedented growth of exploration and production costs. According to the current estimates, oil companies expenditures on geological exploration, development and production have more than tripled since the beginning of 2000s. In many ways the increase in costs is tied to the depletion of convention oil resource base. The growing demand for hydrocarbons forces companies to develop unconventional and highly costly reserves. The companies are producing oil from deepwater shelf, operating high viscosity oil fields and extracting oil from tight reservoirs.

In today’s market about 15 mb/d have commercial production costs above $70/bbl. for example, shale oil projects in the US on average are profitable at the $80/ bbl cost of oil.

Therefore, even if demand for oil falls significantly, its equilibrium price is unlikely to stay below $70-80/bbl for long.

Future growth in production will primarily come from the development and operation of unconventional reserves. In 2010-2025 over 70% of increase in supply of liquid hydrocarbons will come from the use of hi-tech production methods and alternative fuels such as natural gas liquids (NGL), GTL/CTL and biofuel.

The greatest increase in production will come from the deepwater shelf, tight oil reservoirs in the US, heavy crude from Canada and Venezuela. we also expect increase in production of NGL, primarily in the Middle East and in the US.

NORTH AMERICA BECOMES THE LEADER IN PRODUCTION GROWTH

For the next decade North America will remain the leader in terms of growth in production of liquid hydrocarbons. By 2025 the aggregate volume of liquid hydrocarbon and biofuel production in the US and Canada will amount to 19 mb/d, thus significantly reducing the region’s dependency on oil imports.

Just several years ago few believed that such growth is possible in a region with consistently declining production at brownfields. But large-scale deployment of innovative technologies has forced many to review their evaluations. The United States will continue to increase liquid hydrocarbon production with the help of shale oil, development of deepwater shelf and growth in NGL production In Canada production growth will primarily depend on the oil sands. By 2025 production of high-viscosity oil in Canada will reach 3.6 mb/d, which is 1.7 mb/d more than this year. Production growth in Canada may be significantly constrained by logistics and environmental concerns.

BIOFUELS

According to our estimates, rapid growth in biofuel consumption that the world has been experiencing since mid-2000s is unlikely to be repeated. European biofuels have high production costs and until recently have been developed with the help of subsidies. In Germany, for example, cost of biodiesel production is almost two times higher than the cost of production of regular diesel fuel. The crisis, however, is forcing the European governments to cut biofuel subsidy programs and, as a result, many European producers are experiencing losses. In addition to this, the European Commission has proposed to lower the target level of 1st generation biofuel consumption to 5% of the total volume of motor fuel consumption, while the current target level is 10%. If this suggestion is passed, it will have a negative effect on the consumption of biofuels in Europe.

The United States are the world’s largest biofuel producer, but situation there is also far from optimistic. It was believed earlier that development of biofuels is a strategic necessity capable to decrease American dependency on imported oil. But the growth in production of unconventional hydrocarbons has reduced the role that biofuels were meant to play in the provision of American energy security.

Many experts doubt whether biofuel production is justifiable from the environmental point of view, since, as a rule, production of fuel from crops requires fossil fuels. Taking the stated circumstances into account, we have a rather conservative view of the future biofuel prospects.

OPEC‘S BALANCING ROLE

Today OPEC countries control about 42% of global oil production. Thanks to their coordinated actions, cartel members are capable of rapidly reacting to changes in the market situation by introducing production quotas. such actions helped to stabilize oil prices rather quickly during the global financial crisis of 2008. Oil prices act as a decisive factor for budget revenue planning of OPEC countries. As a result of the Arab Spring, budgetary obligations of certain cartel members have grown significantly. According to the existing estimates, breakeven price that allows the Saudi Arabia to balance its budget was about to $78/bbl in 2012.

The probability of further budget expenditures growth needed to stimulate the economy and implement infrastructure projects is quite high for the next 2-3 years. for example, saudi Arabia’s budget for 2013 envisions increase of 19% in budgetary expenditures. Therefore it should come as no surprise that Saudi representatives regularly voice the price of $100/bbl as the target level.

In medium term, as production by independent producers, especially the US and Canada, grows, OPEC members will limit the growth of their own production, thus supporting the global oil prices at necessary levels.

GTL (gas to liquid) – CHALLENGE FOR THE OIL MARKET AFTER 2020

One of the most promising alternative to the oil fuels is the GTL technology. This technology, based on the synthesis of liquid fuels from coal or methane, has been used back in 1940s in Germany, which experienced shortage of oil during the World War II. GTL technology makes it possible to refine methane from the natural gas into a wide spectrum of products, the most important of which are the diesel fuel and kerosene with improved environmental credentials. Today revival of interest in this technology is a result both of the stricter environmental requirements for the motor fuels and of the possibility of operating gas fields in regions lacking gas transportation infrastructure. The largest active GTL project today is Pearl GTL. Сurrent market prices make it profitable. The only project currently under construction is the Escravos GTL in Nigeria. A relatively small number of active and planned projects is a result of the high costs of building GTL refineries. Over the next few years the GTL technology won’t present a serious challenge for the oil industry. But beyond a few years the situation may radically change due to further development of methane conversion methods. Among the promising methods is the microchannel technology that makes it possible to substantially reduce the physical size of reactors, leading to reduction in capital investments in construction. We believe that development of the GTL technology may have a significant influence on the oil market after 2020. Should the GTL technology gain large-scale circulation, it’s possible we’ll see the spread between oil and gas prices to narrow.

INFLUENCE OF THE DOLLAR EXCHANGE RATE

Since the oil prices are denominated in USD, dynamics of American currency’s exchange rate will influence the global oil prices. As a rule dollar depreciation leads to growth in oil prices, while dollar appreciation does the opposite. The influence of the dollar exchange rate on oil prices can be illustrated by comparing dynamics of oil prices in USD with oil prices, denominated in Swiss francs and gold. Over the period of 2000-2012, the price of oil denominated in USD increased by 3.9 times, while the price of barrel denominated in Swiss francs only grew by 2.2 times, while the price of oil denominated in gold actually fell. If the dollar was tightly tied to the gold standard, the price of oil over the last decade would be practically unchanged. Over the last decade we’ve been seeing a trend towards dollar depreciation against other global currencies. In many ways this is a result of the US monetary policy. Depreciation of the dollar stimulates the US economy by having a positive influence on exports. Along with the economic growth, the currencies of the developing countries, especially the ones from the Asia Pacific region, are appreciating. Most likely this trend will continue in medium term, encouraging growth of oil prices.

OIL PRICES FORECAST

Population growth and high rates of automotive growth in Asia will encourage increase in oil consumption in the medium term. Growing demand and natural decline of production at conventional oil fields will require development of new reserves. Recently there is a steady trend towards E&P costs excalation which can be explained by the depletion of conventional fields. As the increase in production will be by high cost sources such as deepwater fields, high-viscosity oil and oil from tight reservoirs, the production costs will continue to grow. Taking into account the high cost and technological achievements in oil production, biofuels won’t have serious stimulus for gowth in production. The increase in oil production in North America will be gradual which will allow market players to adjust to changes. Medium-paced increase in oil production is expected in Iraq where the planned production probably won’t be reached due to technological and infrastructural shortage. OPEC will strive to keep the prices above $100/bbl to meet its budget commitments as the independent producers increase the production. Above all, the trend towards US dollar depreciation is one of the important factor that influence on oil price increase. According to our estimates, it’s unlikely that the price of oil will fall below $100/bbl in the medium term.

GLOBAL TRENDS IN REFINING STRUCTURE OF DEMAND FOR OIL PRODUCTS

Over the course of 2012-2025, global oil product consumption will grow by average annual rate of 1.2%. In medium term, the transportation sector in developing countries w ill r emain t he m ain d river o f o il p roduct demand growth. China is already the world’s largest market for new passenger cars. Analysts expect high growth rates in Chinese car ownership and forecast that by 2025 total number of cars in China will reach to 266 mln. Growth of Asian car fleet will spur growth in demand for gasoline, while the commercial transport sector will contribute to the growth in demand for distillate products. Increase in consumption both in light and fuel oil products will be registered in the Middle East countries that have traditionally been a big consumers of fuel oil. Persian Gulf countries use fuel oil in electricity generation, industrial production, in the process of water desalination and as a fuel at refineries. Developed countries have reached their peak in oil product consumption. Both Europe and North America are at the stage where their car market is nearing saturation. Improvements in fuel economy will limit the growth in oil product consumption. Consumption of gasoline in the developed countries will continue to fall, while demand for distillates will increase due to stricter environmental requirements for bunker fuel and increase in demand from the commercial transport sector. Global demand for diesel fuel will grow the fastest among all the oil products. By 2025 share of diesel fuel in global oil product consumption will increase from the current 32% to 37%. This will require changes in the configuration of existing refineries.

EUROPEAN OIL REFINING IS EXPERIENCING SYSTEMIC CRISIS

The period of 2004-2008 was the “golden age” of European oil refineries. stable demand for oil products and the deficit in conversion capacities made the oil refineries highly profitable. But after the global financial crisis of 2008 situation in the European oil refining industry changed significantly. Decrease in demand for oil products that hit Europe in 2009 led to reduction in throughput of European oil refineries. This coincided with construction of several conversion projects, which meant that the spread between dark and light oil products narrowed further. Moreover, the largest gasoline consumer - the United States - reduced import volumes. All of these events had a negative effect on the economics of the European producers. As a result, the European oil processing industry is undergoing a deep crisis. Since 2009 producers have shut down a number of oil refineries with aggregate output capacity of 3.7 mln bbl/ day in the Atlantic Basin region. However, this seems to be insufficient as many European oil refineries have low profitability, while their utilization remains rather low. Quite a few low-efficiency oil refineries continue to function. Oil companies are unable to radically cut operations due to the pressure from local authorities and labor unions. High risk of shutdown is especially certain for small oil refineries with low level of complexity because such oil refineries have high per unit operating costs. To overcome the European oil refining crisis, the companies have to shut down additional 1-1.5 mb/d of refining capacities.

GLOBAL OIL REFINING CAPACITIES

It’s expected that in 2012-2020 annual net increase in global oil refining capacities will amount to 1 mln bbl/day. The greatest increase in refining capacitites is forecasted for the Middle East and Asia Pacific region, where demand for oil products will grow the fastest. Scheduled projects have high capacity and complexity, challenging the European oil refiners. Moreover, the oil refineries under construction have advantages in terms of logistics, providing them with an opportunity to make profit from arbitrage. China, the largest oil product consumer in the Asia Pacific region, is forced to import part of its fuel. In order to reduce its dependency on oil product imports, the country plans to increase its own oil refining capacities by 2.4 mb/d by 2018. One of the world’s leading refiners - sinopec - plans to build several new oil refineries. In particular, Sinopec is building an oil refinery with capacity of 300,000 b/d in the sourthern province of Guandun in partnership with KPC (Kuwait Petroleum Company). Together with PdVSA CNPC is impleting Jieyang project with output capacity of 400,000 b/d. In addition to this CNPC is building 400,000 b/d oil refinery in the Zhejiang (Taizhou) province. The Middle Eastern countries are also planning significant investments in construction of additional refining capacity in order to satisfy the growing domestic and global demand. Saudi Arabia plans to building three new oil refineries with output capacity of 400,000 b/d each and aggregate capacity of 1.2 mb/d. Al-Jubail facility located on the Persian Gulf coast will be put in operation in 2013, while two others - Yanbu and Jizan - will be built on the Red Sea coast by 2016-2017. Commissioning of new capacities in Asia and the Middle East will lead to reallocation of oil product flows. Export of gasoline from Europe to the Middle East will decrease, while competition on the European diesel fuel market will grow. Growth of global primary crude oil processing will be accompanied by the construction of new conversion facilities. New oil refineries in the Middle East and China have high Nelson complexity Indices and this implies that they have extensive conversion capacitites. for European oil refineries the average Nelson Index equals 7 units, but for the new capacities in the Middle East and Asia this figure amounts on average to 10 units. Construction of new conversion capacitites will continue to take place in the developing countries. The most popular production processes will include hydro cracking units used for production of diesel fuel and high quality motor oils, catalytic cracking units used for production of high octane gasoline and the coking unit that allows for refining heavy residues into petroleum coke with production of additional light oil products.

CONCLUSION

Nowadays it is obvious that the implementation of new technologies has made the development of wide range of unconventional resources possible. This has changed the balance in the oil and gas industry and inaugurated transition to the era of high-tech energy industry. A good example of technological breakthrough is the shale gas revolution in the US, where production of unconventional hydrocarbons has grown significantly over the last few years. Nonetheless, we are quite conservative in our estimates of the future growth of the shale oil production due to existing uncertainty in estimations of actual reserves in shale formations. Such long term trends as the global population growth, urbanization and motorization in Asia, will promote growing oil consumption. The growing demand will be primarily satisfied from costly unconventional sources of supply, while biofuel will have less stimuli for development. Therefore we see no basis for medium term decline in oil prices below $100/bbl. OPEC policies and dollar depreciation will also support high oil prices. Oil production growth in North America had a large influence on the global oil refining industry. The US cut gasoline imports and became a net exporter of oil products, negatively affecting the European oil refineries. The Middle East and Asian countries plan to commission new highly efficient refining facilities and this will lead to redistribution of international oil product flows, toughening competition on the European market. As a result, the European oil refining industry’s systemic crisis is unlikely to be overcome in the next few years. Global gas consumption will grow the fastest among all fossil fuels. Growing demand will be satisfied from a variety of sources of supply, both conventional and unconventional gas. As the LNG market and spot trading develop, the gas market will become more global and competitive. With existing pricing mechanisms Russia will face further improvement of competition on the European market. In this situation the markets of the Asia Pacific look like the most promising direction for Russian gas exports. Despite the favorable pricing environment, there is a risk that oil production in Russia will begin to decline in 2016- 2017, as long as current projects under development are unable to offset decline in production at the currently producing fields. Stable production is possible only if the oil companies intensively employ EOR and develop unconventional resources - and this requires additional tax stimuli from the government. The government has created conditions necessary for modernization of the Russian oil refining industry. By 2025 production of light oil products will grow considerably, while production of fuel oil will be cut by 3 times. At the same time, situation on the gasoline market over the next few years will remain rather tense. In order to guarantee stable development of the oil refining industry and avoid seasonal deficit of gasoline, the government has to provide market predictability and rules for “the game”. *Article source here

Welcome to Lubrita.com

International Lubrita Distributors network and World wide Oils & Lubricants online stores.